Vietnam: REGULATORY SANDBOX FOR FINTECH COMPANIES IN BANKING SECTOR

We published a newsletter regarding REGULATORY SANDBOX FOR FINTECH COMPANIES IN BANKING SECTOR in Vietnam. To view PDF version, please click the following link.

→REGULATORY SANDBOX FOR FINTECH COMPANIES IN BANKING SECTOR

<REGULATORY SANDBOX FOR FINTECH COMPANIES IN BANKING SECTOR>

16th September, 2024

One Asia Lawyers Vietnam Office

I. Introduction

In order to promote the development of new products, services, business models, and technological applications in line with the directives for Vietnam’s socio-economic development during the fourth industrial revolution (Industry 4.0), the State Bank of Vietnam (“SBV”) has released a new draft decree (“New Draft Decree”) regarding the regulatory sandbox for financial technology (“Fintech”) in the banking sector (“Regulatory Sandbox”). This draft is based on Article 106 of the Law on Credit Institutions dated January 18, 2024.

The New Draft Decree has been widely published since early March 2024 to gather feedback from relevant parties. It focuses on general principles, conditions, and approval criteria for participation, aligning with Fintech solutions’ innovative and creative nature, which may not fully identify risks.

II. Approval criteria to participate in Regulatory Sandbox

Participating entities in the Regulatory Sandbox include credit institutions, branches of foreign banks, and Fintech companies (“Fintech Companies”) that have been granted a Certificate for Registration of Participation in Regulatory Sandbox (“Participation Certificate”) by the SBV (“Participating Entities”).[1]

The New Draft Decree clearly outlines the principle of limiting the maximum number of Participating Entities approved to participate in the Regulatory Sandbox.[2] The SBV shall determine approvals based on its ability to assess applications and supervisory capacity during each period, in line with the current market development conditions and based on the voluntary involvement of entities. The Participating Entities approved in each period will be decided and publicly announced based on the total number of submitted applications. Therefore, there is currently no specific quota defined for how many credit institutions or Fintech Companies will be granted a Participation Certificate.

That said, the above regulation poses risks as once the maximum number of Participating Entities is reached, Fintech Companies with groundbreaking or more creative Fintech solutions may be unable to participate in the Regulatory Sandbox during the approved phase. The New Draft Decree does not clarify whether the entities excluded in the current round of approvals will have the opportunity to apply in subsequent rounds, nor does it specify the timeline for the next review period, which could affect entities’ business plans. Perhaps we need to observe this aspect more closely in the future.

III. Fintech solutions covered under the Regulatory Sandbox

The New Draft Decree significantly limits the scope of fields that permitted testing within the banking sector compared to the two previous drafts published in May 2020 and April 2022. It has reduced the eligible fintech solution from seven fields[3] to three, including:

(i) Credit scoring.

(ii) Open application programming interfaces (“Open API”).

(iii) Peer-to-peer lending (“P2P Lending”).

IV. Conditions for Fintech Companies to obtain the Participation Certificate

a) For credit scoring and Open API

Fintech Companies registering for credit scoring and Open API will be considered for granting Participation Certificate if they meet the following criteria and conditions:

- The solution contains technical and business contents that have not been clearly and specifically regulated or guided under current legal regulations for implementation and application;

- The company is a legal entity duly established and operating legally within the territory of Vietnam; not have undergone division, merger, consolidation, conversion, dissolution, or bankruptcy; and

- The legal representative and General Director (Director) must have at least a bachelor’s degree in economics, business administration, law, or information technology and at least two years of experience as a manager or executive in the financial or banking sector and must not be subject to any prohibitions under the law.

b) For P2P Lending

Fintech Companies registering P2P Lending will be considered for granting Participation Certificate if they meet the following criteria and conditions:

- The Solution (i) contains technical and business contents that have not been clearly and specifically regulated or guided under current legal regulations for implementation and application; (ii) is innovative and creative, bringing benefits and added value to service users in Vietnam, especially Solutions that promote financial inclusion. (iii) is equipped with a risk management framework, limits negative impacts on the banking system and foreign exchange activities, and has a reasonable plan for handling and mitigating risks that arise during testing process; (iv) has undergone review and evaluation by the Participating Entities in terms of operation, function, utility aspect; and (v) is feasible for market deployment after the completion of the Regulatory Sandbox.

- The company is a legal entity duly established and operating legally within the territory of Vietnam; it is not a foreign-invested enterprise, has not undergone division, merger, consolidation, conversion, dissolution, or bankruptcy and is without pawnshop business lines.

- The legal representative and General Director (Director) must not have a criminal record or be sanctioned for violations in finance, banking, and cybersecurity; they must not concurrently be the owner, manager of a financial service business, credit, pawnshop, or multi-level marketing business, or be the owner of a tontine group, or be a member of the Board of Directors, Members’ Council, Supervisory Board, General Director (Director), Deputy General Director (Deputy Director) and equivalent positions in credit institutions, branches of foreign banks, entities providing payment intermediary services.

- The legal representative and General Director (Director) must have at least a bachelor’s degree in economics, business administration, law, or information technology and have at least two years of experience as a manager or executive in the financial or banking sector and must not be subject to any prohibitions under the law.

- Meet the standards for personnel, infrastructure, and technology for the P2P Lending platform with the following minimum requirements:

(i) The information technology and data storage system must be located within Vietnam, ensuring safe and uninterrupted operation in the event of incidents, particularly technical and technological incidents.

(ii) All customer and related parties’ data and information must be stored and shared on a highly secure technological platform, ensuring transparency and confidentiality according to the law.

(iii) Technology testing and evaluation must be conducted before implementation.

(iv) The number of technical staff must be proportional to the system’s scale, ensuring stable and continuous system operation.

With the P2P Lending Solution, the New Draft Decree only permits domestic entities to engage in the field, excluding foreign-invested entities.

This regulation aims to protect Vietnamese investors and borrowers from potential risks and fraud from overseas. Domestic entities are subject to the supervision of Vietnamese authorities, making it easier to prosecute violations. Dealing with foreign-invested entities can be complex and challenging while financial activities are still fluctuating.

V. The application dossier for Fintech Companies to participate in the Regulatory Sandbox

Under the New Draft Decree, the required documents for Fintech Companies to participate include:

- A document describing the organizational structure and management for implementing the Solution.

- A proposal describing the solution registered to participate in Regulatory Sandbox.

- The plan for trial and termination.

- Personnel files of managers, legal representatives, and key persons.

- Establishment License/Enterprise Certificate Registration issued by a competent state authority in Vietnam.

For Fintech Companies specified in section IV.b), along with the above-mentioned documents, the following must also be provided: (i) Minutes/Resolutions of the Members’ Council/Board of Directors/General Meeting of Shareholders approving the proposal describing the P2P Lending Solution; (ii) a technical solution explanation and acceptance certificate with the cooperating organization (if any); (iii) sample contracts, applicable conditions, and terms; and (iv) the charter.

The application dossier requirements for Fintech Companies seeking to participate in the Regulatory Sandbox in Vietnam are meticulously crafted to ensure comprehensive preparation and transparency for both the participating entities and the SBV. It obliges Fintech Companies to clearly articulate their operational frameworks, management strategies, and the specific fintech solutions they intend to test. By requiring detailed dossiers, the SBV aims to create a supportive yet vigilant framework that encourages the development and implementation of innovative fintech solutions.

VI. Duration of the Regulatory Sandbox

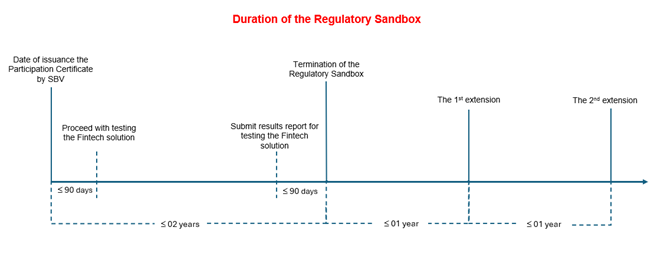

The Regulatory Sandbox for Fintech solution is a maximum of two years, depending on the specific solution and field, starting from the date of issuance of the Participation Certificate by SBV.

Within 90 days from the date of issuance the Participation Certificate by SBV, the Fintech Companies must proceed with testing of the Fintech solution within the Participation Certificate’s scope. After this period, if not due to force majeure, Regulatory Sandbox will be stopped and the Participation Certificate will be revoked.

Fintech Companies must submit results reports for testing Fintech solutions at least 90 days before the termination of the Regulatory Sandbox and may submit a written request for an extension if the official legal framework for a solution being tested has not yet been released or there is a need.

The SBV may decide to extend the trial period based on the results report and actual supervisory conditions. The extension is up to two times, with each extension not to exceed one year.

The duration and extension provisions of the Regulatory Sandbox for Fintech solutions by the SBV are designed to foster innovation while ensuring rigorous oversight. The initial two-year period, coupled with the possibility of up to two one-year extensions, provides a flexible yet controlled environment for Fintech Companies to develop and prove their technologies. This approach benefits both the Participating Entities and competent authorities by balancing the need for innovation with the imperative of maintaining financial stability and consumer protection.

VII. Other notable provisions

- The Regulatory Sandbox is limited to Vietnam; cross-border testing is not allowed.

- Participating Entities are required to issue and provide customers with risk advisory guidelines when using the Solution during the Regulatory Sandbox period.

- Participating Entities are responsible for reporting periodically and providing ad hoc information relating to process, emerging risks and results of the program to the SBV.

Furthermore, Participating Entities are subject to an obligation to provide the preliminary assessment report of the results of participating in the Regulatory Sandbox after 6 months or 1 year (depending on duration granted by the SBV).

- P2P Lending Fintech Companies must report customer credit information to the National Credit Information Center (CIC); report credit information related to the lending party to the SBV and comply with legal regulations on anti-money laundering.

Thus, the approval of the draft decree on the Regulatory Sandbox will empower competent authorities to monitor, assess, and control the innovative solutions implemented by Fintech Companies in the banking sector. This will speed up the enhancement of the legal framework, establish the necessary conditions and legal basis for these solutions to operate effectively.

The promulgation of the official decree will be a major step towards a more innovative and inclusive banking sector. By creating a controlled environment for testing and refining Fintech solutions, the Regulatory Sandbox will help mitigate risks associated with new technologies. This approach prioritizes consumer protection and technological advancement and contributes to the overall growth and stability of financial technology in Vietnam.

—–

[1] Article 3.3 the New Draft Decree

[2] Article 5 of the New Draft Decree

[3] These fields include (i) Credit extension, (ii) Credit scoring, (iii) Application programming interface (API), (iv) P2P Lending, (v) Blockchain technology, (vi) Other technology applications and (vii) Other support services (savings, capital mobilization)