A Peek into Malaysia’s Proposed Consumer Credit Act

We published a newsletter regarding Malaysia’s Proposed Consumer Credit Act. To view the PDF version, please click the following link.

→A Peek into Malaysia’s Proposed Consumer Credit Act

A Peek into Malaysia’s Proposed Consumer Credit Act

July 2023

One Asia Lawyers Group

Yuki Hashimoto

Lawyer (Japan)

Heng Zhen Hung

Legal associate (Malaysia)

1. Introduction

On 4 August 2022, the Consumer Credit Oversight Board Task Force, supported by the Ministry of Finance, Bank Negara Malaysia (‘BNM’) and the Securities Commission Malaysia (‘SC’), released the Public Consultation Paper Part 1. This survey was about the proposed Consumer Credit Act (CCA), a plan to bring together the rules for the credit industry. This idea was first mentioned in the 2021 Malaysia Budget Speech. The CCA aims to create a structured system for authorizing non-bank credit providers, enforcing minimum conduct standards, and curtailing predatory practices via intensified supervision and regulation.

The CCA’s goal is to safeguard credit consumers by promoting professional standards, transparency, and responsible lending while preventing predatory practices. It covers key areas like ethical conduct, advertisement, credit agreements, financing charges, credit assessment, debt collection, repossession, and financial relief. A ‘credit consumer’ includes individuals or small businesses intending to obtain credit primarily for personal or domestic purposes, enterprises not exceeding a credit amount of RM500,000, and individuals acting as non-profit guarantors. The CCA will also establish an authorization framework that mandates licensing for direct credit providers and registration for service providers to credit consumers or providers. A vital component of this framework is the Consumer Credit Oversight Board (CCOB), which is set to act as the competent authority under the CCA.

2. Timeline

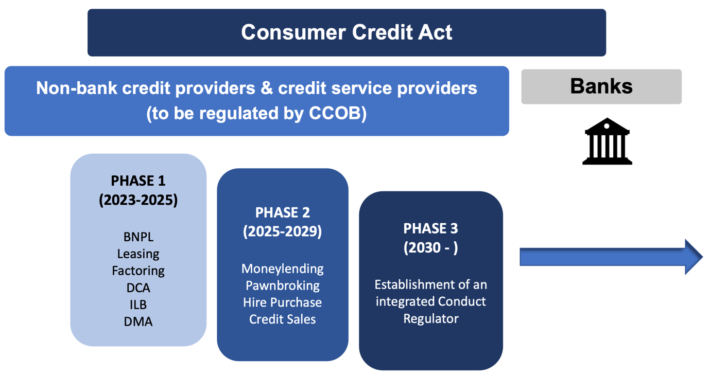

According to the Public Consultation Paper Part 2, which was released on 5 April 2023, the CCA will be put into action in phases. Phase 1, scheduled for 2024-2025, mandates non-bank credit providers and service providers not presently subject to direct regulation to apply for authorisation and come under the CCA’s regulatory framework. Entities such as non-bank leasing and factoring companies, and those offering ‘Buy Now Pay Later’ (BNPL) schemes, will be included in this phase. Notably, non-bank credit providers currently regulated by a Regulatory and Supervisory Authority (RSA) will not need to seek CCA supervision during this phase. In Phase 2, starting from 2025, the CCOB will take over regulatory powers for credit providers and service providers currently under the jurisdiction of the Ministry of Local Government Development (KPKT) and the Ministry of Domestic Trade and Cost of Living (KPDN), this would entail licensed moneylenders under the Moneylenders Act 1951 will be governed by the CCOB.

Please see below the proposed timeline for the implementation of the CCA,

*ILB stands for Impaired Loan Buyers

**DCA stands for debt collection agencies

***DMA for debt management agencies

3. Key Definitions

Certain key terminologies have also been outlined as follows,

‘credit’ – an arrangement, agreement or facility, in whatever form or by whatever name called, which

(a) results in a person being in debt or incurring a financial obligation; or

(b) allows the payment for goods or services sold to a person to be made in instalments;

‘credit agreement’ – an agreement entered into between a credit provider and a credit consumer under which credit is provided;

‘credit consumer’ –

(a) an individual who obtains, has obtained or intends to obtain credit wholly or predominantly for personal, domestic or household purposes;

(b) a person who is a micro or small enterprise who obtains, has obtained or intends to obtain credit, where such credit does not exceed RM300,000;

(c) any other person or class, category or description of a person as may be specified by the CCOB;

or

(d) an individual who acts as a guarantor, not for the purpose of making a profit, to a credit consumer under paragraph (a), (b) or (c) in respect of a credit agreement to which the CCA applies;

‘credit business’ –

(a) moneylending;

(b) pawnbroking;

(c) hire purchase;

(d) credit sale;

(e) BNPL scheme;

(f) leasing; or

(g) factoring; and includes such business carried on in accordance with Shariah principles;

‘credit service business’ –

(a) impaired loan or financing acquisition activity;

(b) debt collection services;

(c) debt counselling and management services;

(d) online crowdlending services; or

(e) repossession activity;

‘credit provider’ – a person who carries on a credit business;

‘credit service provider’ – a person who carries on a credit service business; and

‘controller’ – in relation to a licensed credit provider or registered credit service provider, means a person who

(a) is entitled to exercise or control the exercise of, not less 33% of the votes attached to the voting shares in the licensed credit provider;

(b) has the power to appoint or cause to be appointed a majority of the directors of the licensed credit provider or registered credit service provider; or

(c) has the power to make or cause to be made, decisions in respect of the business or administration of the licensed credit provider or registered credit service provider and to give effect to such decisions or cause them to be given to.

4. Proposed Structure of Governance

The CCA introduces a dual form of authorisation involving the licensing of credit providers and the registration of credit service providers. The authorisation procedure primarily evaluates whether an entity can uphold professional standards of conduct and ensure that its business activities do not adversely impact consumers. The CCOB considers several factors, including the applicant’s organisational structure, shareholding composition, financial resources, and the qualifications and competencies of its key personnel.

A critical feature of the governance requirements is the division into organisational needs and board responsibilities. Organisational needs encapsulate specific structural and operational requirements, such as having a structure with defined roles, implementing an effective risk management framework, and establishing a comprehensive complaints management system.

Board responsibilities emphasise the strategic direction, compliance, risk management, and ethical conduct of the company. For instance, the board could be composed of members with diverse backgrounds, such as finance, law, and technology, but its size should not hinder its deliberation. Essential functions such as an internal audit function and a compliance function, overseen by senior personnel, are also prerequisites. The focus is on maintaining high professional standards and ensuring the protection of consumers.

This framework echoes the current standards imposed by Bank Negara Malaysia (BNM) on its regulated entities.

5. Financial Requirements

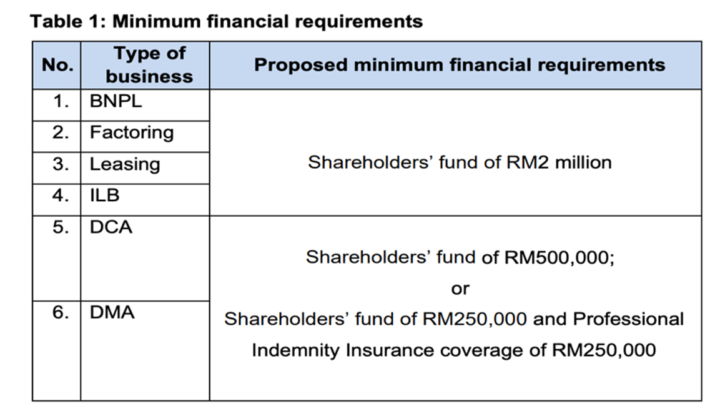

The CCA further outlines comprehensive financial requirements for credit providers and credit service providers, entities must demonstrate sufficient financial resources in line with their business complexity and scale,

In addition to these requirements, firms are also expected to submit yearly audited financial statements to the CCOB or relevant RSA, confirming adequate financial resources for the upcoming 12 months.

6. Fitness and Probity

The CCA imposes fitness and probity requirements on all providers. Key personnels, such as controllers, directors, and senior management, must demonstrate their ability to execute their responsibilities effectively, honestly, and with integrity.

These individuals must adhere to the fit and proper requirements specified in Appendix 2 of the Public Consultation Paper Part 2. Any changes in the role of controller or chief executive officer must also receive prior written approval from the CCOB.

7. Shariah Governance

Businesses offering Islamic credit services must be structured based on appropriate underlying Shariah contracts that properly reflect its business activities. Licensed Islamic credit providers are expected to appoint a Shariah adviser or establish a Shariah committee and develop internal policies on Shariah governance. Any questions from these providers may be submitted to the BNM’s Shariah Advisory Council (‘SAC’).

8. Prohibited Conducts

Under the CCA, certain business conducts are explicitly prohibited, including:

- Behaviours that deceive or mislead a borrower. This could involve providing false or misleading information about the nature, conditions, or cost of products or services.

- Actions involving:

- Deliberately making misleading, false, or deceptive statements, images, or promises; and

- Dishonestly hiding or confusingly presenting important facts.

- Harassment, unnecessary pressure, or threats of physical violence against a borrower during the promotion, issuance, or collection of credit products or services.

- Demanding payments from a credit consumer in any form for unrequested products or services. This includes making threats to initiate legal proceedings.

9. Guidelines for Providers

Credit entities bear the responsibility of promoting their offerings honestly, steering clear of any misleading activities in their marketing. They must provide clear, accurate, and complete information about their products and services throughout the customer relationship, allowing consumers to make informed decisions.

The terms of service should adhere to principles of fairness, allowing the clients the flexibility to transition between different products or providers. Any fees associated with early termination should only reflect the necessary recovery costs. Charges and interest rates should be fair and not excessive.

Prior to establishing any credit agreement, providers must perform an in-depth affordability assessment, utilizing the Debt Service Ratio (DSR) computation as detailed in paragraph 14.6 of CP2 to ascertain the client’s capacity to meet repayment obligations. Providers must align their lending policies with DSR values that allow buffers for clients’ expenditures, minimizing the client’s vulnerability to sudden financial consequences. In times of financial troubles, providers are expected to support clients by adjusting credit contracts to reflect the altered conditions.

10. Hire Purchase Framework Changes

Firstly, the traditional interest calculation for fixed rate hire purchase loans, Rule of 78, as required by Section 30 and the Sixth Schedule of the Hire Purchase Act 1967 will be discontinued due to its unfair structure. The “Rule of 78” is a traditional method of calculating loan interest that allocates a higher portion of the interest payments to the early period of the loan tenure. In other words, the borrowers have to pay more interest and little principal at the start of their loan, and towards the end of their loan repayments, they would be paying little interest and more principal, so if they want to pay off their loan early, they would end up paying more than they might expect. It has been recognized globally as unfair to borrowers, particularly those who wish to settle their loans early, as it results in a higher principal amount outstanding to be repaid. This method has already been prohibited in jurisdictions such as Australia, New Zealand, the UK, and some US states due to its structure. Instead, the reducing balance method, which calculates interest based on the remaining loan balance, will be adopted. This change means that hire purchase providers will be permitted to offer only fixed and variable rate loans, making the charges more equitable and comprehensible for consumers.

Secondly, the reforms give hire purchase providers the option to employ digital and electronic signatures and to deliver notices through electronic channels. In addition, a maximum limit of 17% per annum will be set for the Effective Interest Rate (EIR) under both fixed and variable rate methods. The EIR reflects the true cost of a loan by taking into account the effects of compounding, thereby offering hirers a more transparent view of their financial obligations.

Lastly, hire purchase providers will be required to disclose the EIR at the pre-contractual stage, in their advertisements, and on their websites. To comply with this requirement, providers are expected to make adjustments to ensure transparency and access to this information for hirers.

11. Conclusion

In conclusion, the CCA is set to bring in substantial changes to Malaysia’s credit industry. While the specific timeline for its full implementation remains to be announced by the CCOB, the phased introduction of the CCA indicates the imminent transformation of the industry’s regulatory landscape.

In the meantime, it is prudent for all credit providers and credit service providers, to prepare themselves with the proposed rules and regulations under the CCA.